Meet Cleo: the app that lets you chat to your bank account

Product review • January 8, 2017

2016 really was the year of the Chatbot and as we enter 2017 we are set for dozens of new financial products built around conversational UIs to enter the market.

A product that caught our eye last year though was Cleo – a chatbot service that allows you to have a conversation with your bank account and credit cards.

Accessing your bank account is a faff, having to enter multiple login details and passwords and then more often than not, you are presented with a clumsy interface with very basic details regarding your latest transactions.

Banks are slowly but surely getting there with most now offering mobile apps which are making up for the short comings of their web app counterparts.

What they’re not doing though is providing a conversational interface so that you can ask natural language questions regarding the details of all your financial activity in one place without having to login to multiple accounts and click or tap around a series of interfaces. That’s the job that Cleo is hoping to do for you.

Getting started

Signing up with Cleo is pretty straightforward – you enter the usual username and password details and once you’re in you can then connect your bank and credit card accounts to the application so you can start getting more familiar with your money.

For me this posed the first stumbling block – connecting my main bank account was fine but I actually spend most of my personal money through a credit card.

Unfortunately my main credit card isn’t a connection that is offered by the app so the detail of my day to day spending for which I use it for wasn’t accessible. What was available though were the direct debits, transfers and occasional spending I do via my bank debit card.

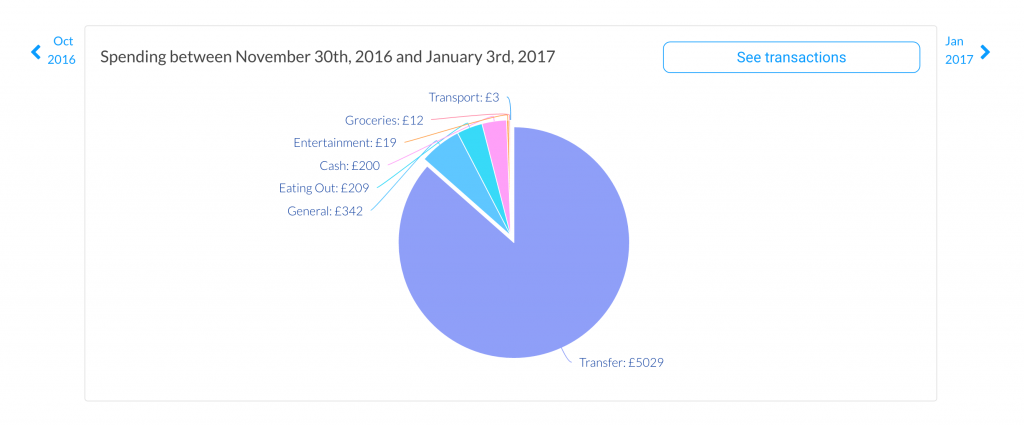

The breakdowns by transaction and category are good but not groundbreaking and there are alternative money management apps that will do the same job. Where Cleo really comes into its own though is in the way in which you can interact with your financials – you can quite literally chat to your bank account.

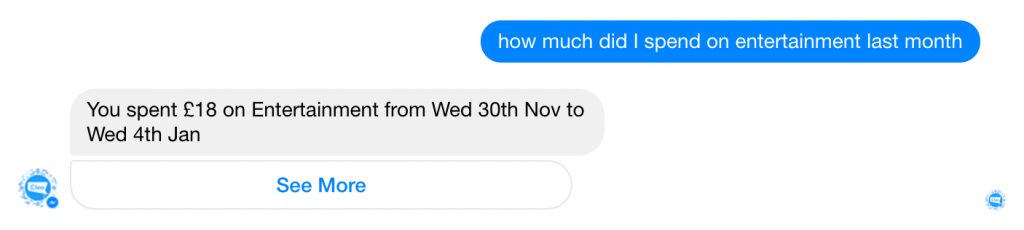

Via SMS or the Facebook Messenger integration – Cleo allows you to ask her natural language questions about your finances.

Just so’s you know, I’m not a complete hermit and do spend rather more on ‘Entertainment’ than the figure above implies but as mentioned earlier, this only reflects spending via my bank account.

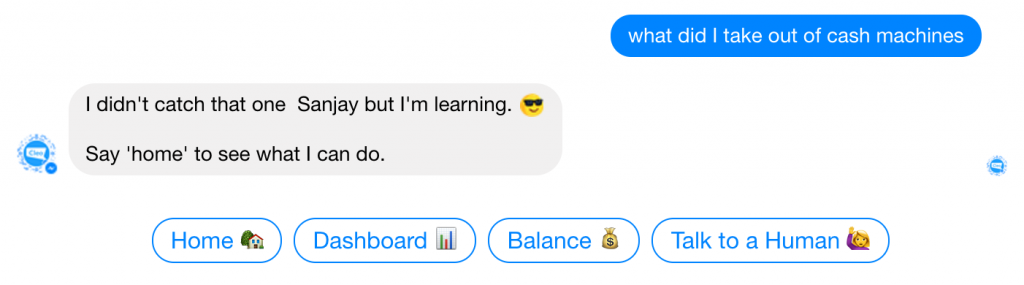

Cleo was great at answering very simple questions but when I enquired “What was my salary last month” or “how much did I take out of ATMs last month” it struggled and wasn’t able to get the answers I was looking for.

Learn by example

The service will get better as it ‘learns’ the range of questions that it might be asked and then how to answer them but I was ultimately left slightly unfulfilled by the experience.

The regular text message updates are handy, reminding me of what’s been spent and large deposits or transfers that have taken place but I can also set that up directly with the bank itself so it’s not really a USP for the service as such.

There are other useful features though like the ability to set budgetary goals and Cleo will even suggest a ‘Safe-to-spend®’ limit based on your income and outgoings. You can use that as a guide and set the limit directly via the Messenger interface (though this won’t action anything on your spending you will just get a reminder from Cleo if you exceed it). These types of features will really help the app gain traction in the future.

It’s clearly early days for Cleo and we look forward to seeing how the product evolves. Conversational UIs are here to stay but there is going to be a substantial period of ‘learning’ what and how human beings speak and most importantly, what they actually mean, before these applications really start delivering substantial utility.