Know your customer: How fintech startups are innovating KYC and credit scoring

Opinion • January 28, 2018

KYC (i.e. Know You Customer) laws have been increasingly tightened and impact both financial institutions and their clients alike. According to a Thomson Reuters Survey, the average financial firm spends £60 million a year on KYC Compliance.

In addition, 25% of applications were abandoned due to KYC friction in the UK. These KYC processes are often inefficient and customers become frustrated with blocked transactions or additional paperwork. Financial institutions are also paying significant fines for lack of sufficient controls. For example, in January 2017, a bank was fined £163 million for AML (anti-money laundering) failures.

In light of these problems, solutions are needed. Enter fintech: New startups that assist with assessing potential clients and their credit worthiness for KYC compliance.

What is KYC?

Know Your Customer (KYC) is about financial institutions identifying and verifying their clients and their background. KYC regulations have increased to help limit fraud as financial institutions need to know that their customers are legitimate and have appropriate intentions (consider terrorist financing and money-laundering). Identity verification, risk factors, credit scores, etc. are all part of KYC.

Many of the current KYC processes are outdated and collecting customer information is therefore inefficient. Fintech startups are taking advantage of this opportunity to provide more efficient practices. These technological innovations are enabling a better understanding of the customer to help financial institutions make better decisions.

Automating KYC processes

Focused on KYC automation, IdentityMind predicts that KYC (along with AML and fraud detection) will move from silos to a single customer view in 2018 and that enterprises will be able to apply a risk-based approach for creating a good digital experience for end users. Headquartered in London, IdentityMind builds digital identities to streamline compliance and enhance fraud prevention for merchant accounts.

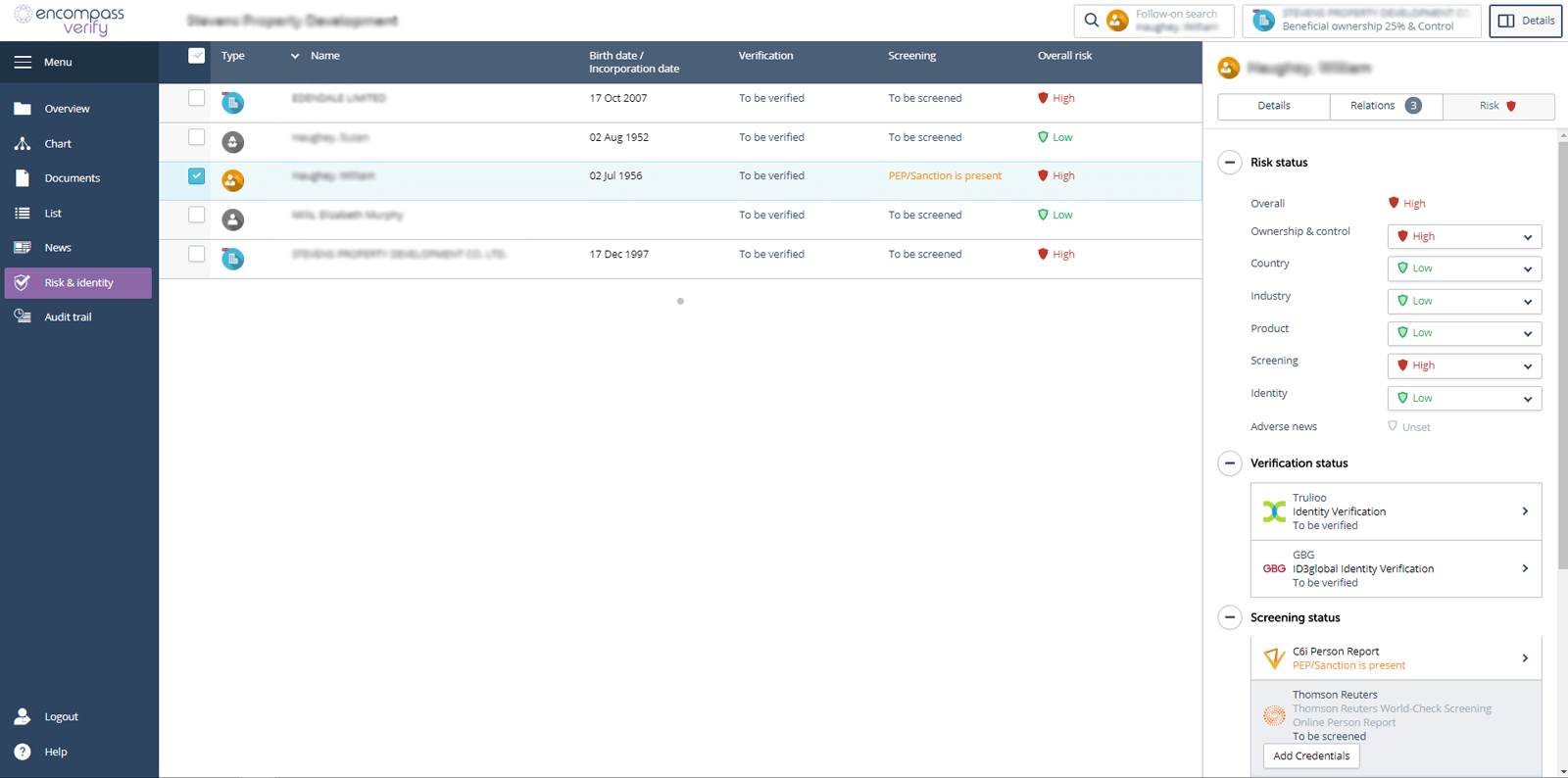

Also based in the UK, Encompass Confirm offers financial service companies automated due diligence and onboarding solutions that ensure internal compliance with KYC procedures.

To deal with the problem of compliance obligations and meeting customer expectations, encompass collects data from leading information providers. The company then automates workflow to align with client’s internal KYC policy.

Additional innovation in KYC

UK based Contego is a fintech company which performs detailed checks on companies, people, and ID documents to assist with reducing risks, business process optimization and ensuring compliance. The risk scoring platform helps fintech firms with a customer onboarding function ensure that they are compliant with KYC and AML regulations.

Similarly, Cynopsis is a company based in Singapore designed to help with KYC, as well as AML and CTF. Desiring to bring regulatory inclusion to clients (small, medium size financial and non-financial service companies), the company’s services include transaction monitoring for combating criminal activities.

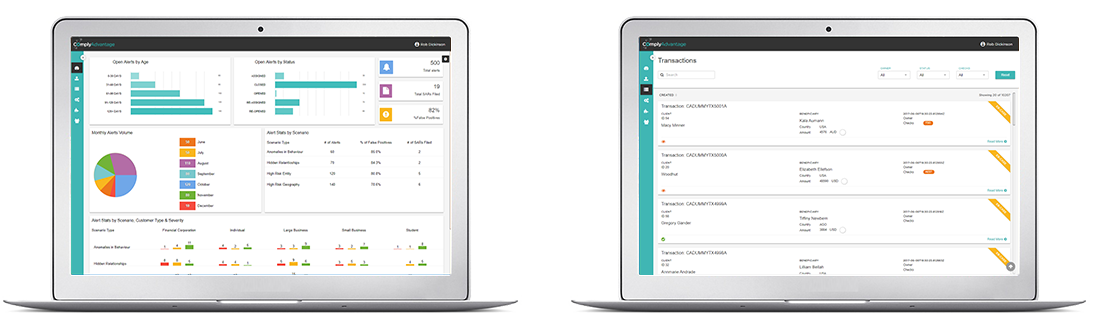

Combining Artificial Intelligence with KYC is UK fintech company ComplyAdvantage which claims to the be world’s only AI-driven risk database on people and companies that pose financial crime risk. The company provides a monitoring platform for KYC processes.

Assessing customer credit

A major part of customer data collection is credit scoring. Scores and checks by credit agencies can help eliminate KYC violations. In addition, more efficient processes assist clients with faster applications and acceptance.

“The KYC procedure was always being followed but it is now getting integrated with credit score checks as well. Banks and other institutions are opting to go via credit bureaus because it helps in solving logistical issues for the lenders,” says Nimilita Chatterjee, a senior vice-president at Equifax, a credit bureau.

Consider fintech startup Credit Kudos which is focused on streamlining credit processes to help with customer authentication. Recognising the frustrations that can accompany credit application due to regulations, the company analyses actual spending/bank transactions of the individual to assess their credit worthiness by using up to date financials to measure risk rather than historical repayments.

Designed to be automated and approachable, Credit Kudos’ product allows customers to securely share relevant information with a lender. The company provides a transparent relationship between individuals and companies to fit unique needs rather than “one-size-fits all.”

In Oct 2017, the company became authorized by the FCA to operate as a credit reference agency. “Instead of relying on slow, outdated measures of creditworthiness, Credit Kudos has built a process that monitors your financial behaviour in real-time, reporting back an FBS that is truly reflective of a borrower,” founders of the company say.

For some people, their line of credit may be affected by an incorrect address or banking errors. Others may not have access to credit. A company creating a solution to this problem is Aire. The firm’s products are designed to help lenders and high street banks better understand applicants such as through the Interactive Virtual Interview.

Serving the previously “unbanked,” Singapore based CredoLab is also revolutionising credit scoring methods through mobile user behaviour. The company partners with banks, consumer finance and other retail lenders and provides financial access to emerging markets.

The bottom line

Regulatory authorities are watching financial institutions closely and failure to comply with new regulations means hefty fines. However, compliance also means paying large amounts to get appropriate processes in place.

By automating through technology and focusing more on the client, KYC and credit scoring processes can become more efficient for both financial institutions and their end-users without sacrificing safety and risk measures.