How insurtech is reinventing the customer experience

Opinion • April 24, 2018

Insurance has been slower than other financial services to harness the power of the tech revolution but now incumbents are starting to look over their shoulder as a wave of Insurtech start-ups are set to disrupt the industry.

Summary: In this article we look at some of the key trends and exciting start-ups that are changing the insurance sector as well as how incumbents can keep pace. Key takeaways for established companies are:

- Consider tackling the often lengthy initial risk assessments and use technology to make them more specific to the customer

- Tailor products to customer segments and behaviours rather than the one-size fits all approach

- Foster innovation within the organisation and consider working with or acquiring innovative start-ups

Most people grimace at the prospect of having to take out any form of insurance. It’s viewed as an expensive yet necessary evil that is reluctantly undertaken to protect against some unlikely event that may or may not happen in the future.

In response to consumer apathy and the reluctance of incumbents to change their ways, start-ups are transforming every part of the insurance value chain: from back office functions such as claims management and policy admin to direct consumer touchpoints such as risk assessment and making a claim – technology is profoundly changing the customer experience.

Here at Vector we are passionate about delivering best-in-breed customer experiences and we’ve identified several ways in which technology is being utilised to dramatically improve the customer journey in the insurance sector.

Comparing the market

My own experiences with insurance are fairly typical of the industry. I’ve recently had to renew or take out new holiday and home contents insurance and in both cases the process of finding a quote started with using a comparison site such as ComparetheMarket or MoneySuperMarket.

This is where the product ‘distribution’ part of value chain has been significantly improved allowing customers to fill in the risk assessment questionnaire online once and then to be provided with a quote instantly online from any number of products and providers. They can then compare quotes and policy details allowing them to make an informed decision as to which provider to use.

Many buyers and many sellers being brought together in an almost perfect market but whilst these services are useful, they don’t address several aspects of the experience that cause so much consternation amongst consumers.

The often lengthy and standardised nature of the risk assessment questionnaires is an area which several insurtechs have tried to tackle. Whilst the questions can be quite detailed, they don’t seem to provide a personal approach to the myriad of specific circumstances that apply to the individuals concerned.

Sensor-tech lead assessment is one way insurtechs are removing the burden of responsibility from the consumer to provide that assessment and instead using technology to determine appropriate premiums.

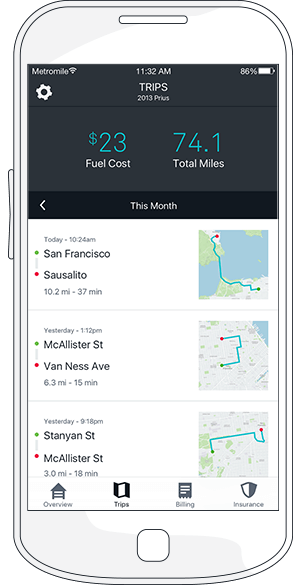

Metromile is one such service in US which offers a pay-per-mile ‘usage-based’ insurance for low-mileage drivers.

A piece of hardware is attached to a car’s OBD-II port (standard for all cars made after 1996) which provides mileage data to dynamically calculate the insurance premium.

FitSense is another US based insurtech utlising hardware, this time wearable technology, enabling the health and life insurers to personalise the products and premiums being offered to customers.

Both these services give the user a sense of control and perceived fairness and ultimately the ability to improve the outcomes by reducing the cost of insurance through their own behaviours.

Insurance for the millennial mindset

Targeting particular customer segments is another way insurtechs are winning over new customers.

We’re not huge fans of the term millenial here so we tend to talk more about the behaviours associated with it more than the age group it defines e.g. being spontaneous and having shorter term goals.

With respect to how these attitudes affect insurance requirements, 2 problem areas for potential customers have been the inability to insure just a few personal belongings rather than a whole flat/house’s contents or the ability to borrow a friends car for just a couple of hours without the hassle of having to take out or modify a full and lengthy insurance policy.

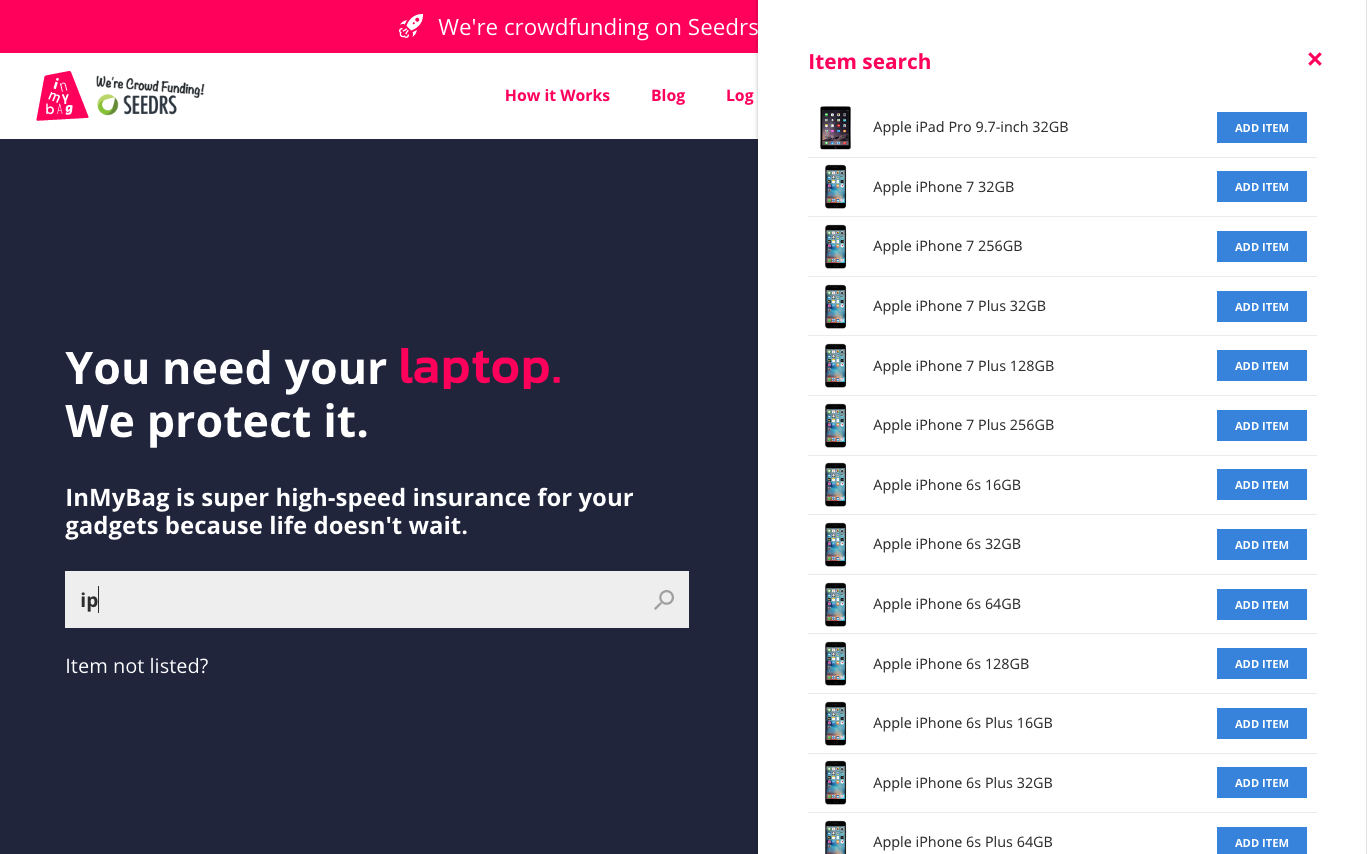

UK based start-up InMyBag has tried to solve the first issue of insurance for a few possessions. The service allows you to add items to a ‘bag’ and provides insurance premiums based on those particular items instead of an estimate of the total value of your possessions that traditional insurers use.

The customer engagement begins directly from the homepage where you are asked to type details of the items you want to insure into a search box, which uses predictive technology to give you a list of options to choose from and you can start building your quote straight away.

You’re then invited to fill in some personal details and upload photos of the items to validate your application and very soon you’re on your way to being insured.

Keeping your account up-to-date is easy via the client interface where you can add or subtract items as and when required.

Judging by the Trustpilot reviews which are mostly positive the company delivers on it’s ‘hassle-free claims’ promise too which is of course the true test of any insurance provider.

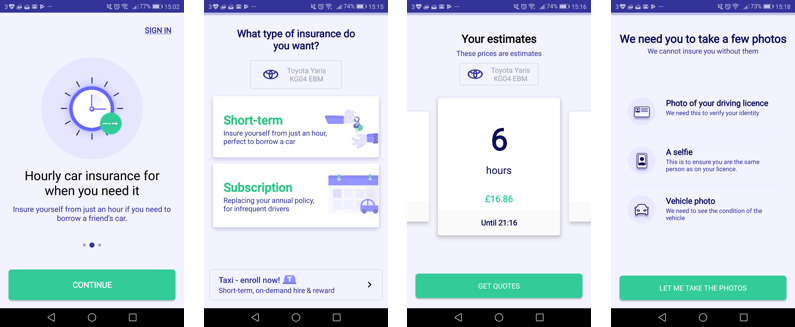

Cuvva is another UK based start-up which has solved the second of the problems: easy, short term car insurance on a friend or family member’s car.

Hiring a car by the hour even through a relatively user friendly service such as Zipcar or DriveNow can become quite expensive but has always seemed preferable to asking friends or family to borrow their car. The latter requires them to phone their insurance provider, an often frustrating experience depending on time of day and service provider, to make the arrangements for what might well be a trivial amount of time spent on the actual road.

This product is a genuine gamechanger though: After downloading the Cuvva app and verifying your email you are routed through a very efficient sign-up process which firstly asks for the vehicle registration of the car you want to borrow and then provides a series of indicative time based quotes for using the car.

Getting the pricing information to the customer so quickly provides fantastic engagement and paves the way for some of the more fiddly application elements such as providing photos of the drivers license, yourself and the car (though all were easy enough through the mobile app).

Insurtech’s competitive advantage

Both InMyBag and Cuvva admittedly do not support all use cases (yet) but appeal to particular customer segments.

Not only can new insurtechs target these gaps in the market that aren’t addressed satisfactorily by incumbents but they can take advantage of the latest UX/UI and back-end technologies as well – free of the legacy issues that their more established competitors might have.

As the Cuvva app demonstrates, this can make for a honed onboarding journey and a very satisfying customer experience that will appeal to far more people then just those with the ‘millennial mindset’.

Established companies are still in the driving seat

Whilst there are plethora of exciting ideas and new firms coming to market, incumbents such as Aviva and Admiral still have a comfortable and sizeable market share.

There are also several ways they can take advantage of the interest in insurtech and insure they are not left behind in the future.

Firstly they can provide the essential backbone to many new providers by being the trusted underwriters to the actual policies that consumers sign up for. Secondly they can learn from the successes of the smaller newcomers and look to emulate their offering and following on from this, thirdly, through partnership and acquisition, they can own these new products and services and develop them without having to overhaul their existing businesses.

The latter has seen Luther Systems work with Aviva on smart contracts that harness the power blockchain and RightIndem are working with Admiral on making the claims process more accurate and reducing ‘leakage’.

Customer first

With all the start-up activity in the insurance sector as well as the response from incumbents the potential winners should be the consumers.

Increased competition has often benefited the customer in terms of price but what we’re seeing with insurtech is the all round customer experience improving hugely as well, with more appropriate products, technology lead risk assessments and satisfactory claims resolutions, a sector that has lagged behind could be about to turn a significant corner.