Fintechs are changing the investment landscape

Opinion • March 12, 2018

Traditional methods of investing are often targeted more at wealthier investors rather than the mass market. According to the Financial Conduct Authority, an estimated two-thirds of financial products are sold without advice.

Many small investors simply cannot afford the investment fees or do not trust current advice options. Fintech startups are rising to the challenge and tech innovations such as ‘robo-advisers’, chatbots and algo-investing are being incorporated into consumer products and services to assist with investing for those who are not financial experts.

Robo-advisers & algorithmic trading

Whereas financial advisors were once more for those with a higher income, robo-advisors break down the financial barrier. This type of online software is designed to help you manage your investments by automatically selecting, building, and managing a portfolio.

Not only are robo-advisers affordable, through trading algorithms, these apps take less time than a human adviser. In addition, robo-advisers can help eliminate investing mistakes as there are no emotions involved.

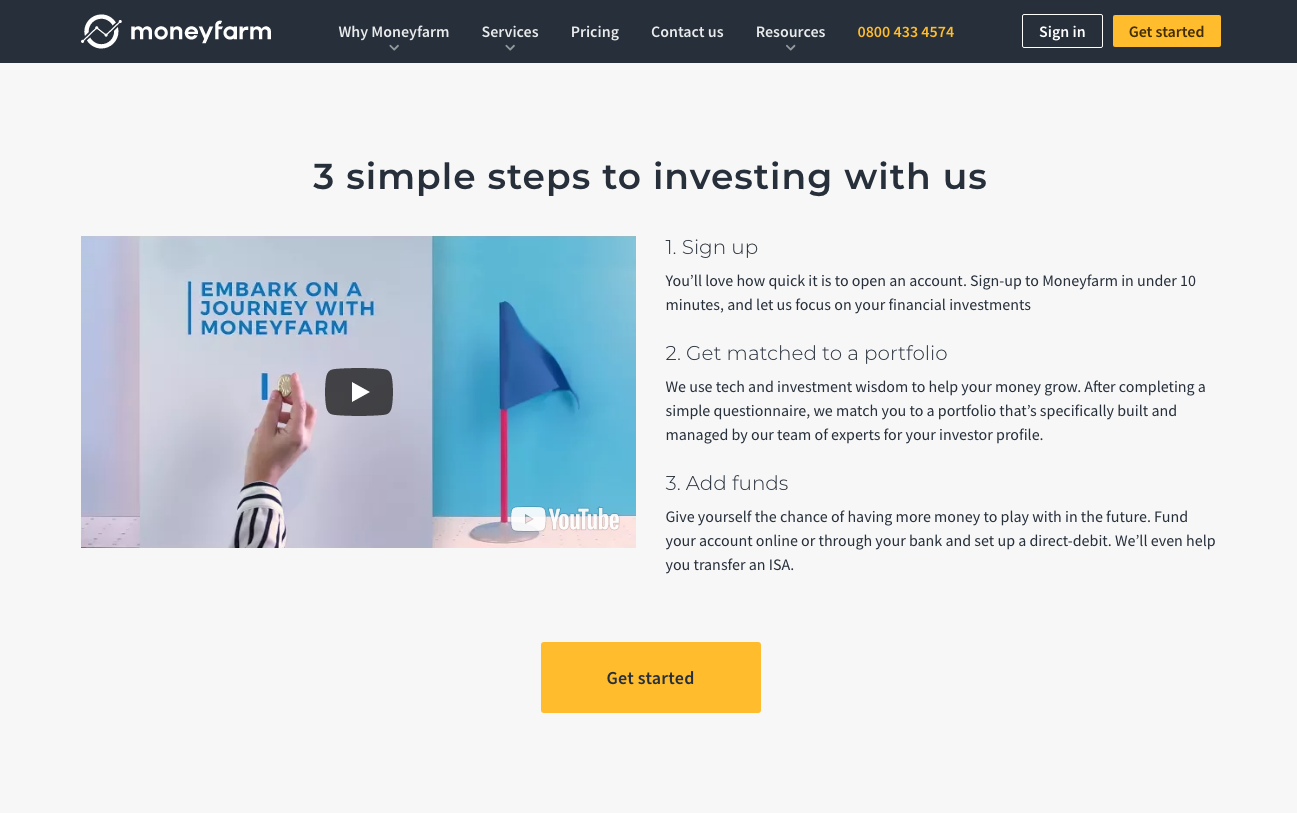

Consider UK and Italy-based Moneyfarm, the digital wealth manager. Wanting to cater to the needs of many, the company has a results-driven investing process. The process is simple. You first sign-up for an account which can be completed in under 10 minutes. You then fill out a questionnaire (assessing your risk preference) to determine what kind of investor you are and receive portfolio guidance and clear investment strategies. After that you add funds to your portfolio and you are ready to go. Moneyfarm will even help you transfer an ISA.

Recently overhauling its fees, Moneyfarm introduced a 0.7% charge for investors with less than £10,000. You can get started with as little as £100. So far, the robo-adviser has received generally positive reviews as being user friendly and transparent.

Scott Gallacher of Moneyfarm outlines that ‘-Technology has made the personal investment process much faster, with low-cost financial advice now accessible to all. Where it can take up to a week to get investment advice from a traditional wealth manager, Moneyfarm’s own algorithms reduce this to seconds.’

Another robo-adviser is California-based Wealthfront where you can start an account with $500. Created for hands-off investors, the company offers free management on small balanced, taxable accounts, automatic rebalancing, and 529 college savings plans management. The management fee is 0.25% but the first $10,000 is free. UK companies Moola, Nutmeg, Wealthsimple also have similar platforms to give access to sophisticated financial advice and/or management.

Cardiff-based Wealthify combines algorithms with human expertise by offering a hybrid investment platform for investment portfolios. CEO Richard Theo recently told Techworld: “We’re trying to democratise investing to make it accessible with a much lower starting point at £250 [Nutmeg starts at £500] and the whole simplicity of design is to target the mass market.”

Micro-investing products

For those wanting to invest, but only having a small amount to get started, there are also options to micro-invest. We wrote a previous article about Moneybox, the micro-investing app that allows users to invest spare change to invest in funds that in turn invest in companies such as Disney, Netflix and Unilever. Moneybox fees are £1 per month and 0.45% of the value of investments per year – no subscription for the first 3 months. The app also recently integrated with challenger bank Monzo to make investing from the current account even easier.

A similar company is Acorns which also rounds up your purchases to the nearest dollar and invests the change. Based in the US and Australia, there is a management fee of $1 a month for accounts under $5,000. Accounts of $5,000 or more pay only 0.25% per year. Investors can also withdraw at anytime and link unlimited cards to round up. No minimum deposit and college students also get up to four years free.

UK-based True Potential also offers an app that allows micro-investing. Savers have the opportunity to put as little as £1 into a multi-asset fund. Investors can invest in funds such as Goldman Sach, 7IM, and Allianz.

Chatbots

Financial chatbots have progressed tremendously over the past few years. From answering basic questions about home loans and finances to almost full service automated financial assistants that they are today, chatbots are becoming more mainstream in the financial world.

Chatbots are software programs that appear in or as messaging apps to perform various tasks. While chatbots are still not yet fully interactive, these assistants can be programed as financial advisers, expense savings bots, banking bots, and tax bots.

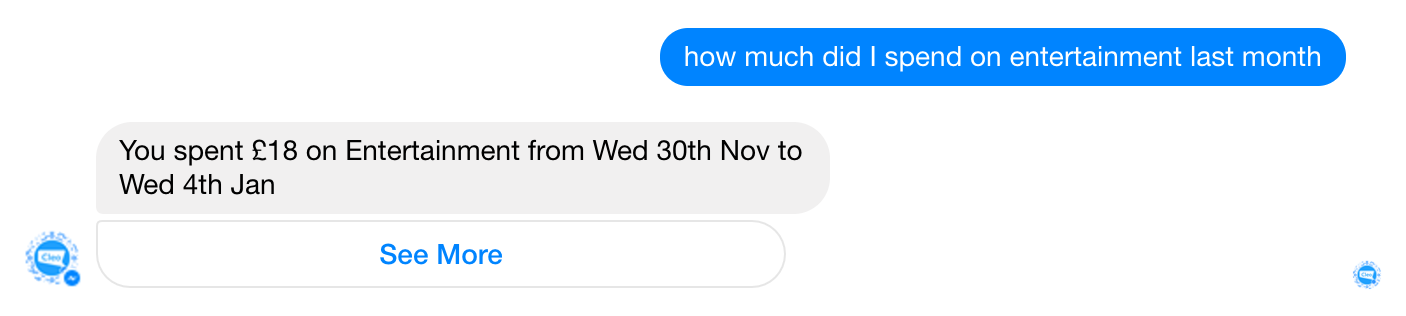

We wrote a little while back about Cleo, a chatbot service that allows you to have a conversation with your bank account and credit cards. Another similar banking bot is Abe – an AI-powered chatbot that enables credit unions and banks to create personalized & intelligent digital banking experiences. Based in Orlando, FL, Abe was founded with the vision of enabling better communication between consumers and banks. The voice and message enabled conversational platform offers financial institutions such as American Banker, Retail Banking, and The Financial Brand a fully customizable solution to engage their customers. The chatbot acts as a digital financial coach that also provides recommendations for investment decisions.

Natwest in the UK is also launching a chatbot to assist customers with investing. According to ITPro, “The bot will determine the best way for customers to invest their money by asking questions such as what they want to achieve from investments, their current financial situation, what they can afford, their debts and other personal information, plus their attitude to risk. It will then suggest ISA products they could consider for investment, plus how much they should consider investing and the most effective way to use their ISA allowance.”

Fintechs drive competition

There are numerous other innovative products and services that are assisting customers with investment decisions. Consider payment apps such as TransferWise and Paym and digital banks such as Atom Bank and N26.

Innovative investment technologies are quickly changing the way we invest, opening up possibilities to services that were once exclusive to the wealthy. With a strong demand from the mass market for smart platforms that match schedules, budget, and saving goals – banks and other financial institutions will need to continue to innovate to stay abreast of the cost effective options that fintechs are offering.