Invest your spare change with Moneybox

Product review • April 11, 2017

ISA season came and went with it’s usual marketing clamour to ‘use it or lose it’ and ‘top up’ otherwise face being taxed on money you don’t have to save in the first place.

Saving and investing is a chore and the tax free allowance of an ISA isn’t necessarily a compelling enough incentive on it’s own for us to save on a regular basis. However, now there’s an app that’s trying to make the process as effortless as possible and aims to help you save and invest without giving you an ulcer.

Moneybox allows you to ‘microinvest’ by connecting to your credit card or bank account and ’rounding up’ on your purchases and then investing the money in a fund that matches your appetite for risk.

For most people, the idea of shifting hundreds of pounds into an investment each month can feel like a huge burden but investing smaller amounts is much easier to contemplate. In fact, Once you’ve set it up, Moneybox means you don’t have to think about it very much at all. We took the app for a test drive to see if it does what it says on the tin.

Sign-up

Moneybox requires you to download the app – no web version unfortunately which is a shame but at 5.74MB it’s nice and light so we’re off to a good start.

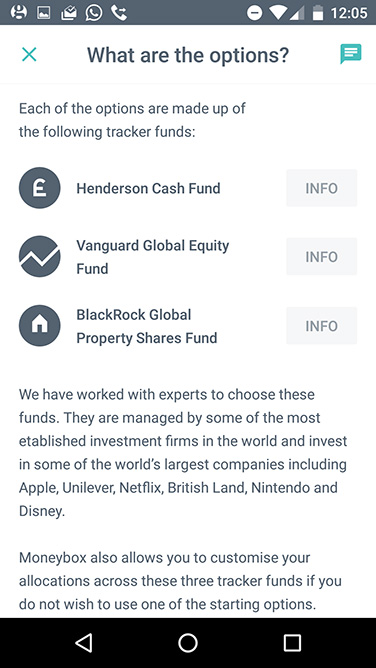

The first surprise is that the funds your money will be invested into are managed by 3rd parties: Henderson, Vanguard and Blackrock. That’s fine but I had assumed that Moneybox had their own funds and fund management team. The service just the application that does the ’rounding’ and depositing of cash into your chosen fund – nothing wrong with that and this is made absolutely clear during onboarding but I wasn’t aware until signing up.

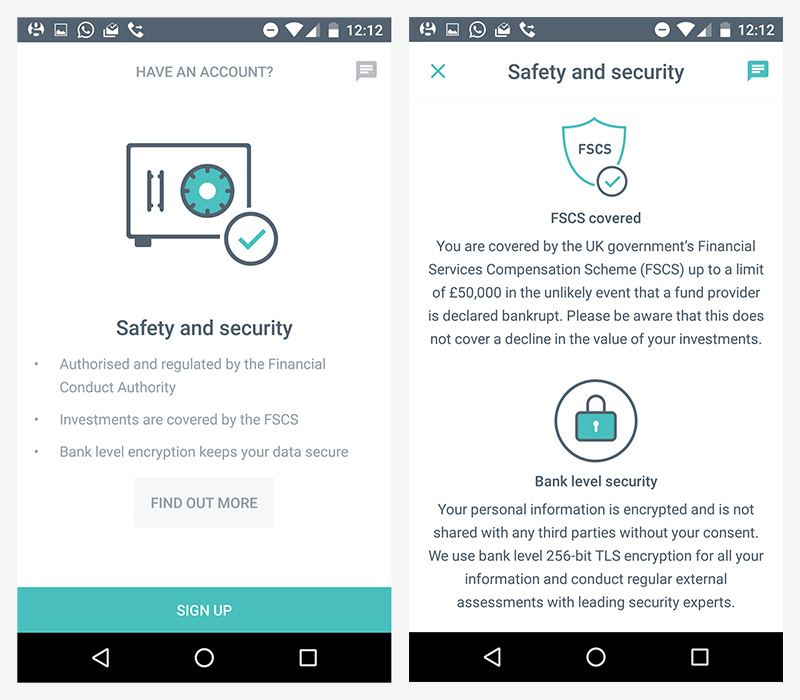

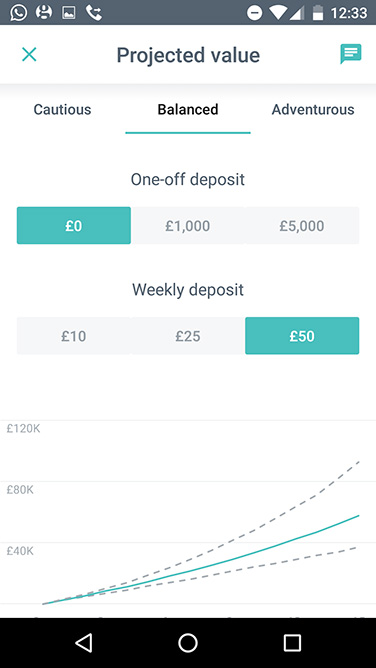

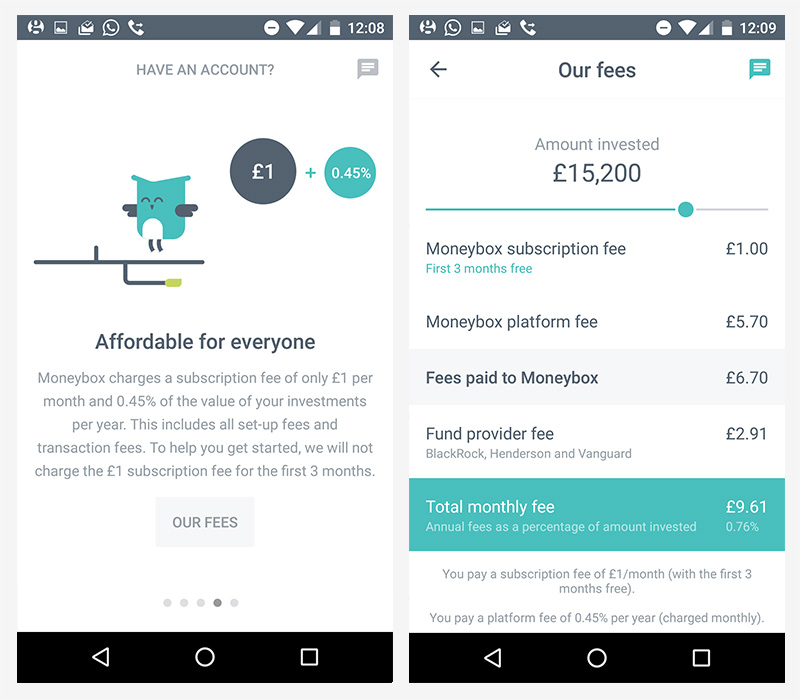

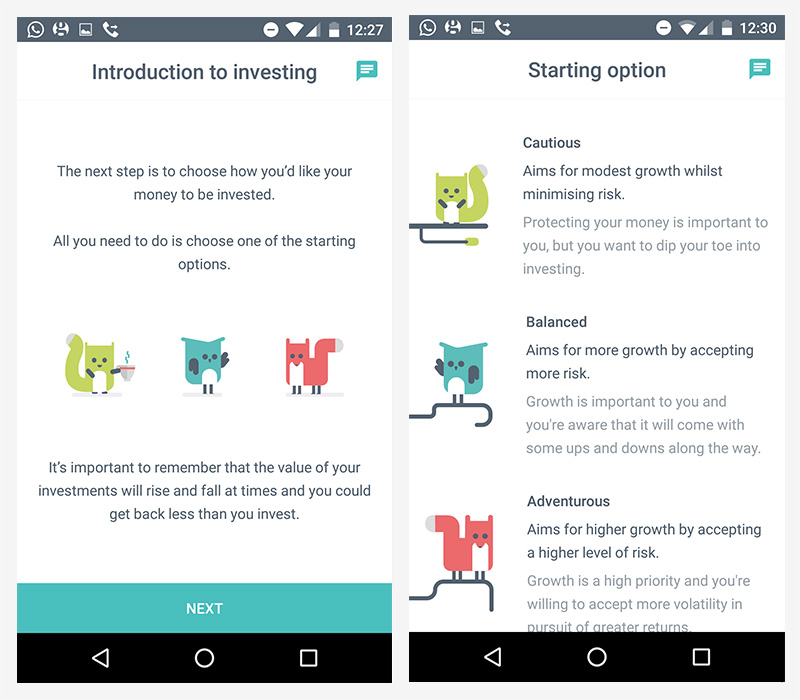

As you sign-up you are presented with several screens of helpful information regarding how the service works and key areas such as security with a clear onward path to read about it in more detail. Sure, some of this is essential compliance stuff but it’s done well and the informative visualisations and a very helpful simulation that breaks down the fee structure based on the investment you might make, instills confidence and shows complete transparency from Moneybox.

The app allows for one-off deposits as well as weekly deposits that allow for additional transfers to the rounded up cash. It is presented in a very simple and accessible way which is good but I would’ve thought ’round-ups’ should be at the top of this screen to reinforce the USP of the app rather than seeing the other methods first.

Connecting to your bank or credit card account is relatively straightforward (though I couldn’t connect to my preferred credit card but was able to connect to my bank). The app then shows details of transactions for your credit card/bank account (you can add multiple accounts) and how much the rounding up will total. You will also have to setup a direct debit to actually make the transfers of cash from your bank but this is taken care of through the app.

Moneybox do a very good job with the UX in handling a relatively complex onboarding process but with the number of steps and amount of information that needs to be presented, I can’t help but think having a desktop version would help speed up the sign-up.

Having said the above, it’s great you can take a picture of your ID via the app as part of the identity check and the wait for confirmation wasn’t long – within 20 minutes I had an email telling me that everything had been verified and I could complete the sign-up workflow.

Fees

Fees are obviously a key aspect to consider when investing – doesn’t matter how great the UX of the app is, along with the performance of your investments, it’s the amount that is being deducted by the service provider that really matters.

Moneybox fees are £1 per month and 0.45% of the value of investments per year – no subscription for the first 3 months. The fees compare OK against the other big providers but they aren’t especially low so this isn’t a big incentive to use the service.

Using the app

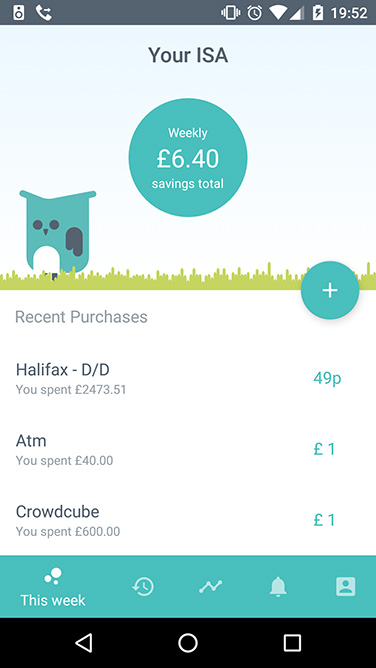

The normal app interface has a very pleasing colour palette of light blues and a range of greens providing a sense of calm whilst I part with my hard earned cash. I even like the little illustrated animal characters – they’re not too juvenile or patronising and strike the balance of seriousness and playfulness well.

The core of the experience for ’round ups’ is a list of your most recent transactions from your connected accounts with a figure showing how much will be rounded up from each payment. For purchases that have nothing to round up e.g. £30.00 the app suggests £1.

It would be good to have a date next to each of the transactions shown from your accounts. I appreciate this might clutter the interface a little but there is a dual utility to using this app as it enables you to check your transactions. If some are seemingly dubious or you don’t recall when you made them then it would be helpful to know when they were made.

There’s a prominent CTA to ‘Add to weekly savings’ which allows you to add any additional sums to your contribution. I suspect for Moneybox to make money over time it will require users of the service to contribute more than just their small change so prompts to ‘Add’ further deposits are very important to the business. It will be interesting to see how they develop the service in the future and what features they add to help their clients save and invest more over time.

I think that’s where the slight quandary lies for me with this app and service; if you don’t choose to use it for it’s USP i.e. investing money via the rounding up method then you’ve just got a simplified investment service that allows you to deposit money into a very limited selection of funds. With several competitors offering an array of investment services with a far greater range of funds, there is a question mark as to why you would choose Moneybox just as an investment service.

On the design side though we think the UX is great – walking the user through the labour intensive sign-up process and including all key information and compliance copy on a small screen is no mean feat and the clean, uncluttered interface to then manage your investing makes the whole experience as simple as the concept itself.

Moneybox will undoubtedly encourage more people to take the plunge with investing and we’re intrigued to see how the app develops in the future.

Update: Moneybox integrates with Starling – the first challenger bank to offer an API.