New year, new home? The products and services that are changing the way we buy property

Product review • January 9, 2019

Buying a new property has come a long way since the days of traipsing up and down high streets picking up printed lists of available properties and then being at the mercy of potentially overbearing estate agents.

Digital has had a profound impact on all parts of the buying and selling value chain and in this article we take a look at the online products and services that have contributed to this transformation.

Searching for a property

Whilst estate agents still form a key part of the buying and selling process, the majority of property searches now start online.

Zoopla and Rightmove are the 2 largest portals and with functionality broadly replicated on both, it mostly comes down to personal preference as to which portal you end up using.

Rightmove has a much larger share of the traffic with more than double the amount of visitors to the website per month than Zoopla (~120 million vs ~50 million respectively).

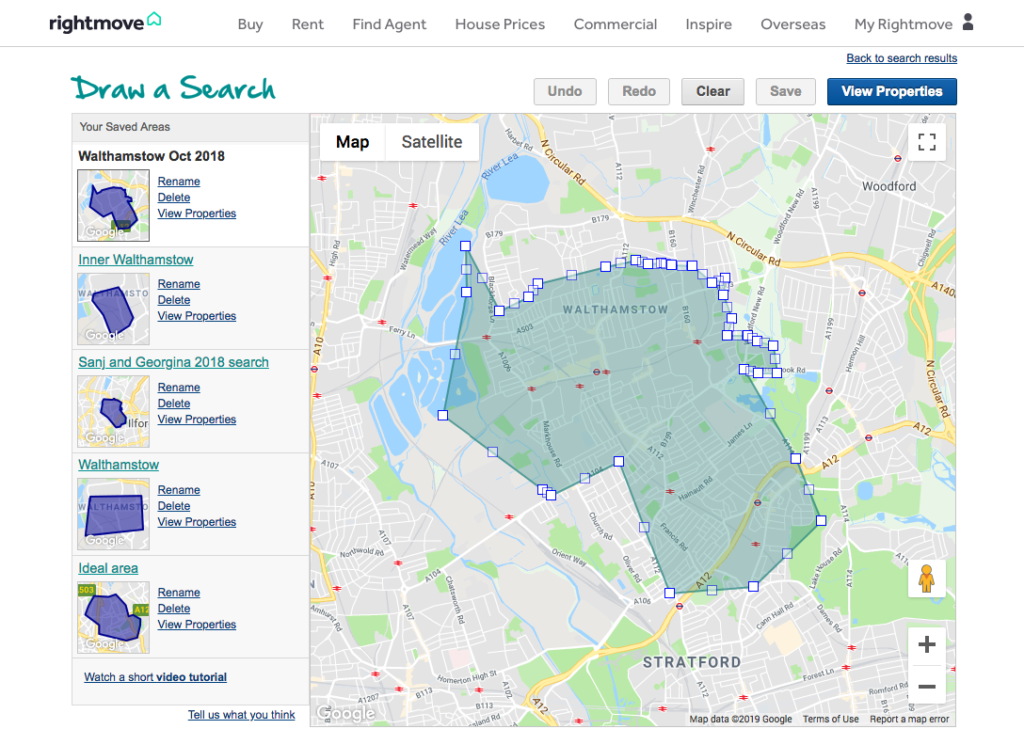

My own preference used to be Zoopla as I found the interface a little more intuitive and the ‘draw your search’ function allowed me to create a bespoke search area by drawing a marquee on a map as opposed to relying on postcodes or road names when I wanted to really hone in on a particular area.

Rightmove has replicated that feature now though and both websites offer more or less the same in terms of search tools including setting up property alerts, seeing valuations for the area and prices of properties sold nearby all of which have really empowered the prospective property buyer.

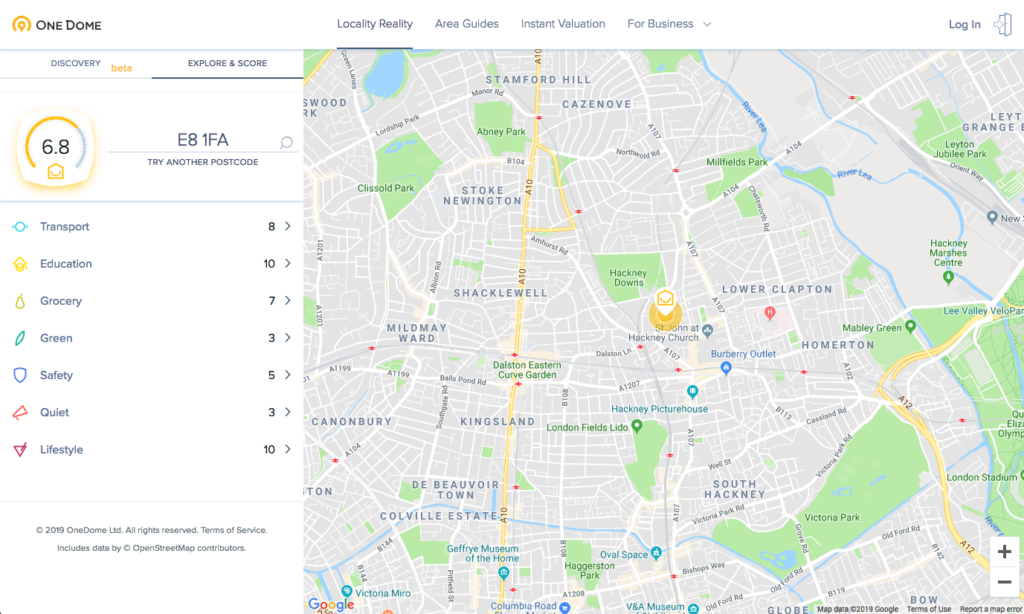

What about if you don’t know where you want to live, how can technology help you? Well OneDome aims to solve that conundrum with it’s ‘Locality Reality’ web service that allows you to search for different areas and see a series of ratings for common criteria that you might use to assess a new area to live in. How good it is transport, shopping, green spaces and safety are presented on a scale from 1-10 along with an overall average allowing you to judge whether the area is right for you. The ‘Discover’ feature reverses the mechanic and allows you to select the levels for each criteria to find the area that is perfect for you.

There are other useful features too including an online valuation service for your property as well as more general editorial area guides to give newbies a useful introduction to a new area.

It’s a data driven service pulling in from a variety of sources including TFL, GOV.UK and the ONS to create a holistic view of an area. It’s a very effective way of getting a sense of an unknown area though I didn’t entirely agree on the assessment of some of the areas I searched for (E8 in Hackney is very green IMO but not according to OneDome!).

Online estate agents

Selling a property can be an equally fraught task and probably deserves it’s own blog post but there are a number of online estate agents that have come to the fore over the last few years which have not only changed the way properties have been sold, but also helped the buyer significantly too.

Perhaps the largest of these is Purplebricks, where sellers pay a fixed fee for listing their property and no commission on the sale.

This concept has really shaken up the market and has seen revenues grow for the company over the past year whilst most traditional estate agents have seen a decline.

The sign-up is slick and simple and you are assigned an agent who will visit your property and provide a free valuation. They will also run through the platform with you that allows you as the seller to see how many views your property has had online and shows any feedback prospective buyers have for you after they have viewed it in the flesh.

Your fee includes photos shot by the agent and you can pay extra to have viewings taken by the agent or alternatively opt to show buyers round yourself.

One of the advantages of the business model on the buyer’s side is that you don’t get a pushy estate agent showing you around – they want to sell the property of course but are not driven by commission and therefor tend to give a more honest appraisal of the property you are interested in.

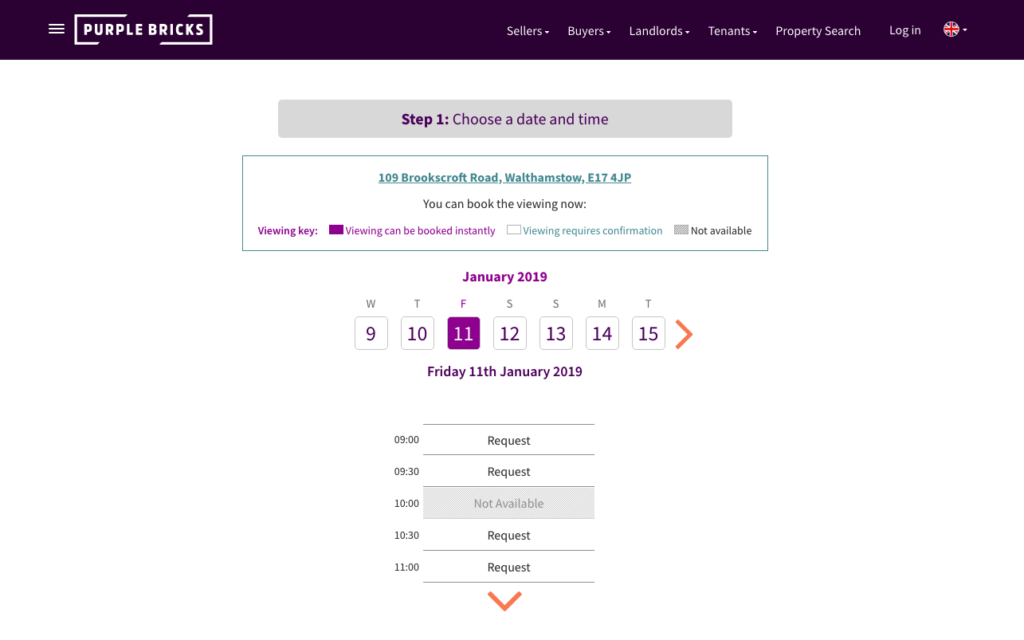

The Purplebricks website property search has improved recently having previously suffered from fairly clunky UX (after searching and viewing a specific property you had to return to the beginning of the search results if you clicked back instead of where you left off). Useful features of the platform include being able to book a viewing by selecting specific date and time (subject to confirmation from agent or vendor) and perhaps most importantly, being able to communicate directly through the platform with the vendor if there are queries and the ability to make an offer directly too. No estate agent in the middle passing messages and offers back and forth.

In terms of service design it’s a game changer – having been at the mercy of estate agents patter and at times intimidating persuasion techniques (being told my offer is waayyyy below what the property is worth) I would much rather have a direct communications channel with the seller.

There are several other notable mentions in this space offering variations of the service such as Emoov, Yopa, 99Homes and Settled.

Nested has taken the mission to fix the property market one step further and has several attractive features to its proposition; they use ‘market leading tools and data’ to give you the most accurate valuation, they promise to get you the ‘best price on the market’ and perhaps most eye catchingly: they can offer an advance (90-95%) if the property is not sold within 30 days.

The breakdown of buying chains is a huge issue when purchasing a property and this solution could really help plug that gap and give buyers and sellers confidence when proceeding with a sale and purchase. It does come at a price though – commission on the advance plan start at 2.5% – over 1% more than the industry average and their own ‘agency plan’ which is 1.3%.

Mortgages and online brokers

There are many online mortgage market places with the same affiliate business model i.e. they get paid by the lender when the customer takes out a mortgage via their website.

It’s as hard to differentiate between the market places as it is between Zoopla and Rightmove but it’s the power of the search and the filters that have proved the most important feature in our assessment and Money Saving Expert’s Mortgage Best Buys gave me the best results during my research.

These are just price comparison sites though and whilst they’re very useful for presenting mortgage products on a broad set of criteria, aren’t really pushing boundaries in their use of technology. There are now a new breed of online mortgage brokers though that go further by matching mortgages based on more detailed criteria including your income and liabilities and therefor provide products that are much better matches for their customers.

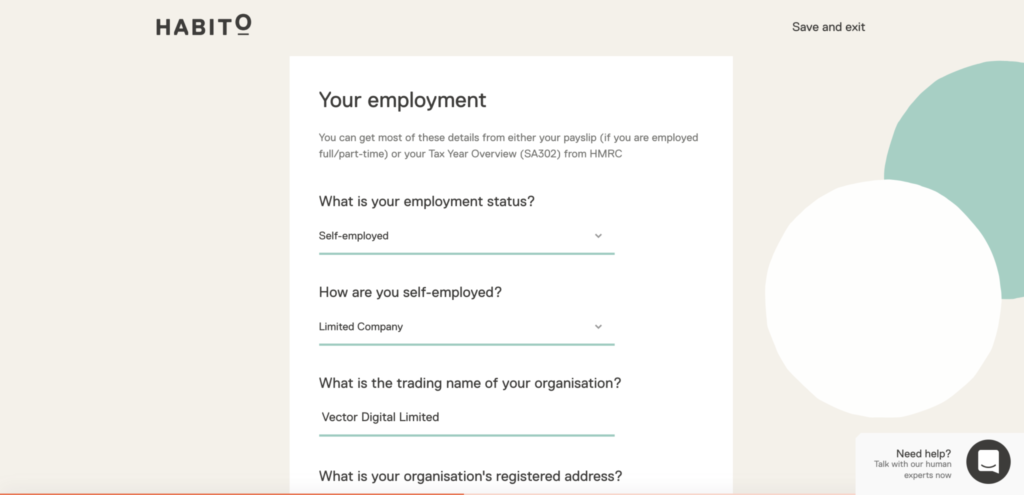

Habito and Trussle are 2 of the most well known services and ask for a series of details about your income, sources of wealth, deposit etc. to then recommend a suitable mortgage product.

We didn’t go through the full Habito customer journey as the questions were quite in-depth so we can’t comment on the service as whole (though friends have used the service and been very pleased). My inclination though given the prospect of 10 minutes worth of online form filling was to pick up the phone and call a broker. That wouldn’t necessarily save on the form filling but having a reassuring voice on the end of phone guiding me through and also being able to discuss different products is a major incentive for opting for the traditional route.

Habito does try to plug those gaps with a chatbot and the ability to chat online with a human as well so they are addressing those concerns. Ultimately the proof is in the product they select and the service they deliver and according to their Trustpilot Reviews there seems to be many happy customers.

Law still catching up

There are other areas of the value chain we haven’t covered in this article – probably the largest omission being conveyancing. Whilst ‘Lawtech’ is delivering some exciting products and services, I struggled to find online conveyancing services that were doing anything particularly different in this space.

Lots of law firms have fairly sophisticated case tracking tools now that keep the client informed throughout the conveyancing process and the days of having to ring a solicitor on a daily basis to get updates on progress are thankfully receding into the distance but game changing start-ups are still thin on the ground.

As a whole though, the property buying and selling process is being disrupted significantly by technology driven companies who are trying to solve specific customer needs with innovative products, services and business models. I look forward to seeing how this might have a positive effect on what has to date been a notoriously tricky marketplace to negotiate and will hopefully make the dream of home ownership that little bit easier to achieve.