UK fintech startups – our pick of the most exciting fintech startups from the UK

Product review • September 18, 2017

The UK and London specifically wants to be the home of fintech and although that status may be at risk due to it’s imminent Brexit, it’s certainly true that there are several exciting and disruptive fintech products and services that have come to the market that were created in the capital.

We take a look at 5 fintech companies that have caught our eye over the last 12 months.

Finimize

Finimize is an email newsletter that contains 2 to 3 financial news stories and is delivered to your inbox each day. What this service does which is really useful though is it also unpacks the significance of the stories and explains what effect it has on investors. It’s a great way to keep abreast of what’s going on and learn about the causes and effects that determine share price and investor confidence.

Finimize is also launching a personal finance management tool which promises to make looking after your finances, from setting up an ISA to retirement planning, much easier.

We liked this fintech product as our research suggests that understanding the mechanics of investing is one of the biggest barriers for people when it comes to making decisions about where to put their money. This email really helps to bridge that gap

Clearbank

Clearbank is the first new clearing bank for over 250 years which means it will be able to reconcile payments between banks breaking the monopoly of the big 4 (The Royal Bank of Scotland, Lloyds, HSBC or Barclays) and shaking things up by offering lower rates and faster turnarounds on this service as well as a host of related services.

By offering lower rates Clearbank will reduce the cost barriers to entry for new fintech companies and encourage more start-ups into the marketplace which is why this B2B fintech startup is such an exciting prospect for us.

Revolut

International payments are a hot topic in fintech and we’ve seen how popular Transferwise and Azimo have already become.

Revolut offers an additional dimension to that of Transferwise by offering a card that you charge up and that you can then use abroad without the fees normally associated with card transactions abroad. You can also send money abroad using messaging app WhatsApp.

As of February this year it also offers a bank account (which you can obtain without proof address) which comes with a personal international banking number (IBAN) allowing you to take payments and route your salary directly from abroad.

We really liked the design of the app and the fact it offered categorisation and bill splitting as well and with it’s competitively low costs it’s established itself as a major competitor to Transferwise.

Trussle

This is one that’s close to our hearts as arranging a mortgage or a remortgage can be a real pain. There are several comparison sites already out there such as uSwitch or MoneySupermarket but whilst they act as affiliates, directing you through to the lender’s website to go through their application process – Trussle allows you to apply through their own platform in less than 5 minutes and has access to more than 90 lenders and 2000 products in the UK.

It will also track the market and alert you to other mortgages with better rates as they appear in order to help you get the best deals on a rate switch.

Having experienced the convoluted application process of 2 major lenders recently anything that speeds up and simplifies the process for mortgages/remortgages is a welcome addition.

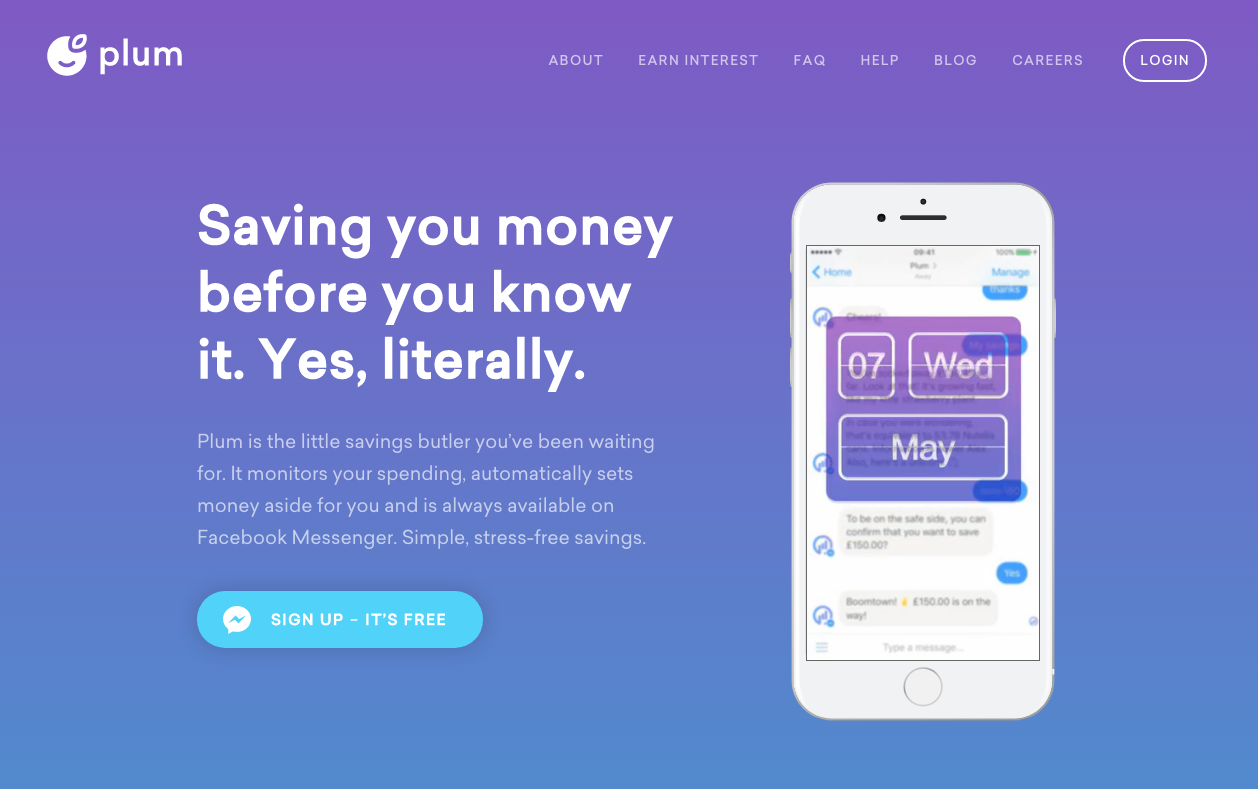

Plum

We’ve looked at automated money saving tools previously on this blog and are already fans of Moneybox which rounds up and invests your small change into an investment fund. Plum is a bit different though in that it utilises Facebook Messenger as the interface with the customer and it suggests deposits based on your bank account and will then transfer the money into your savings account.

It also allows you to have a conversation with your bank account a bit like Meet Cleo but goes 1 step further in allowing you to action withdrawals and deposits directly through messenger.

Conversational UIs are the new paradigm and leveraging Messenger is a good way gaining traction with users. We liked the ease with which you can transfer money to your savings account and make withdrawals via the Messenger interface. Logging into bank account and going through the same process can be a little laborious despite the improvements in UX from the big banks and this feels a little smoother and dare I say it, millenial…

Lots happening as ever on the fintech scene – we will dive deeper into some of the products mentioned here over the coming months as there are some great ideas built on strong innovation. We can’t wait to see what’s coming next.